Multifamily Market - Inside Numbers at Markets Across the U.S.

By Christopher Levarek

“The goal is to turn data into information, and information into insight.”

- Carly Fiorina

IRR, Integra Realty Resources, one of the largest commercial real estate valuation and consulting firms in North America, recently released their “IRR_2019 Annual Multifamily Report”. This report shares insightful information on the status of the Multifamily real estate in the United States today.

Download IRR’s 2019 Annual Multifamily Report Here

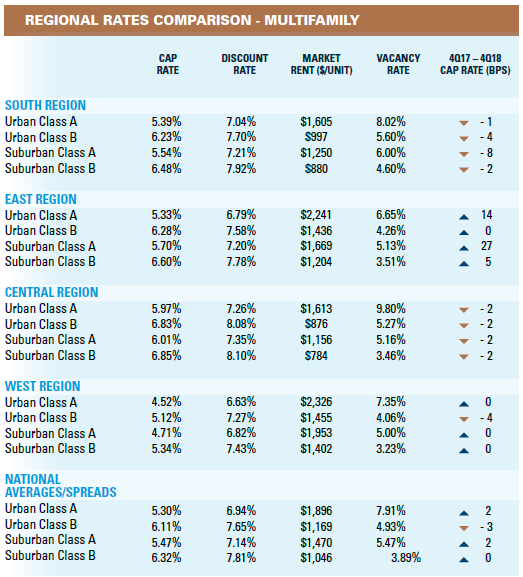

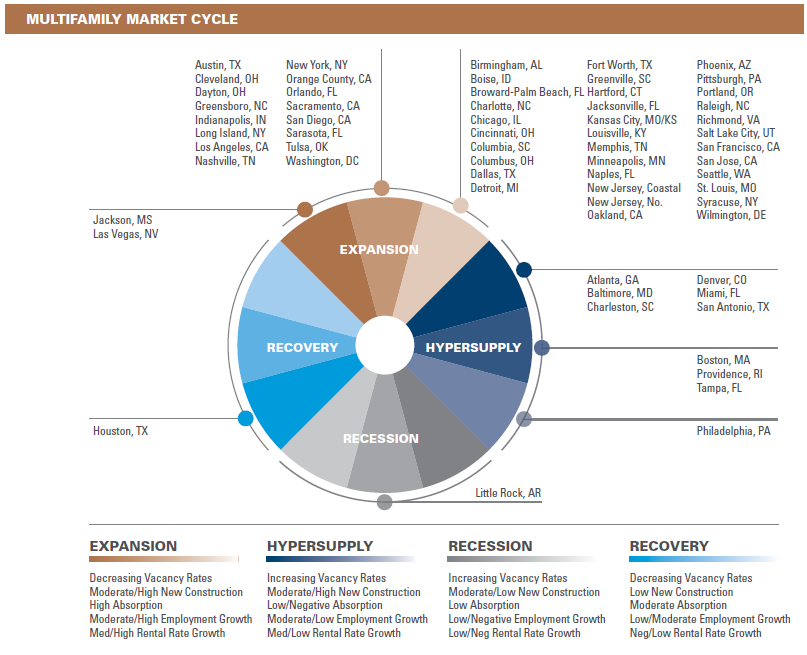

In the below figures, we get a look at the markets that are in expansion, “stagnation” and recession giving helpful insights when looking into investing in a given market. Additionally, we can look at the shared overall regional rates significant in real estate investing in the report or figures below.

Specifically we can use the cap rates and vacancy rates for market selection as a good indicator of possible opportunities. The cap rate is simply the rate of return of an asset based on the income it will generate. It is calculated based on the Net Operating Income(Real Estate Revenue - Expenses) of a property divided by the Purchase Price or (cap rate = NOI/PurchasePrice). It can help multifamily investors to understand how profitable a property is doing and what the current value is.

Here we have the Regional Market Rates, notice the differences in Cap Rates and Vacancy Rates according to Region and Property Class Type, A,B:

IRR Research

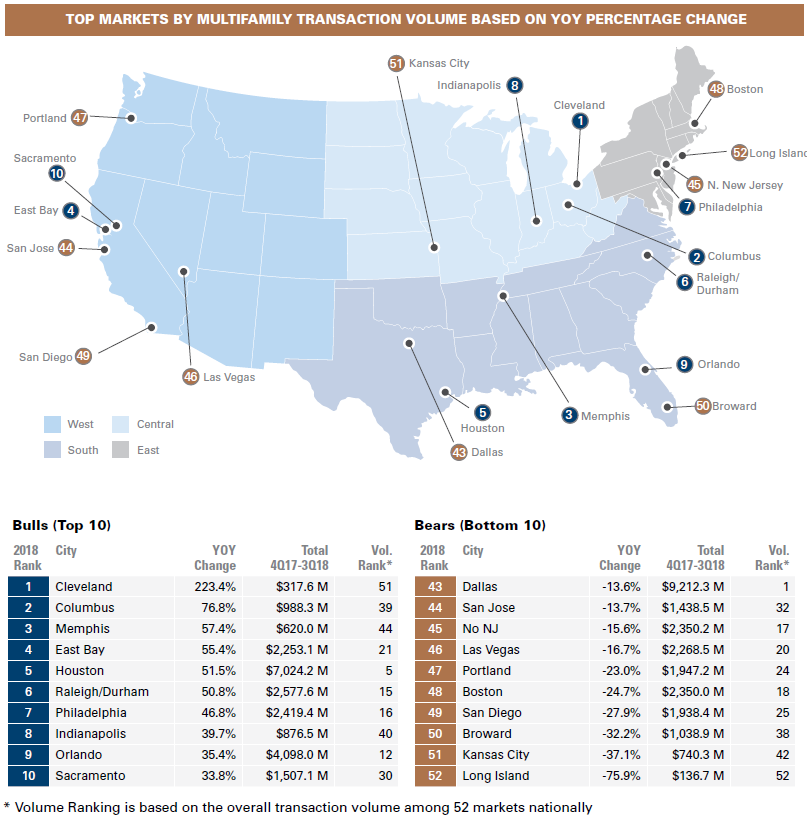

Here we can see the Top Markets in the United States today by Multifamily Transaction Volume:

IRR Research

Here we get a view into where specific markets sit in the “Multifamily Market Cycle” or the ebb and flow of the growth/restriction in these markets:

IRR Research

In Final

We highly recommend following and researching informational reports such as the above to always have a good pulse on the market. Additionally, we continuously post information such as this which can be either followed on our Facebook page or by signing up for our monthly Newsletter. As always, Invest Smart!